Services and Pricing

.png)

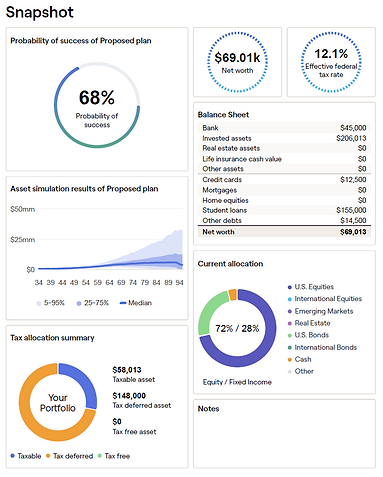

Comprehensive Financial Planning

$2500

*20% discount for Active Duty

There are a lot of payment models used by financial planners. There are pros and cons to all of them. I provide advice only under a fixed payment. This payment includes the following 1-hour appointments

-

Initial Goal Setting and financial discovery

-

Plan delivery

-

Follow up meeting to ensure a successful start

I believe this model is the lowest cost to you. The more popular assets under management model often charges you more money over your advice relationship and the fees will likely increase significantly over time as your portfolio grows. A retainer model will charge you whether you speak to an advisor or not. If you are comfortable making your own trades or want control over your assets, I believe the advice only option will provide you the most value.

Your financial plan will include:

-

Financial Goals: Retirement, education, major purchases, etc.

-

Cash Flow & Budgeting: Income, expenses, saving, debt.

-

Debt planning: Home loans, student loans, auto loans, and credit cards

-

Insurance Planning: Life, Disability, auto, home, umbrella (I do not sell these products)

-

Investment Planning: How to grow your money based on your risk and goals.

-

Retirement Planning: Ensuring you have enough income when you stop working.

-

Risk Management (Insurance): Protecting yourself and your assets.

-

Tax Planning: Strategies to minimize your tax burden.

-

Estate Planning (Basics): Wills, beneficiaries, and passing on assets.

Follow on Hourly Consultations

$250

*20% discount for Active Duty

After we have completed your comprehensive financial plan, it is time for follow ups. These meetings provide:

-

Updates to your goals

-

Progress check

-

Accountability partner

These follow on consultations are optional and based on your needs. If you are going through some big changes or have a specific and timely planning need, I am there for you. Most clients would benefit from 2 follow on meetings a year to make sure they stay focused on their goals.

They can also be for specific topics:

-

Baby on the way or out the door!

-

Marriage/Divorce

-

TSP planning at retirement

-

Survivor Benefit Plan questions

-

Moves

-

Job transitions - old 401ks or new job benefit questions

-

HSA or FSA planning

A comprehensive financial plan is a requirement to progress to hourly follow ups. This ensures I have a complete picture prior to giving out advice.

Contact

I'm always looking for new and exciting opportunities. Let's connect.